Lee Stevens, Public Policy Coordinator at VCC and Kelly Dowdell, Policy & Research Specialist at Momentum

The Canadian Emergency Response Benefit (CERB) has helped many in a time of crisis, but some question if the amount will disincentivize work? But, is that what’s happening? We argue that it is the right amount at the right time until we find a way through this current challenge in our economy.

The Government of Alberta reports that in 2020, approximately 3,000 people on Income Support (IS) and 11,000 people on Assured Income for the Severely Handicapped (AISH) are working in some capacity. These workers may have lost their jobs during the downturn as a result of COVID-19. Those that have earned the minimum $5,000 during the past year (not all of them) are eligible for the CERB just like anyone else. Many of these people are anxious about how the Government of Alberta will treat the CERB as it pertains to the earning exemption rate.

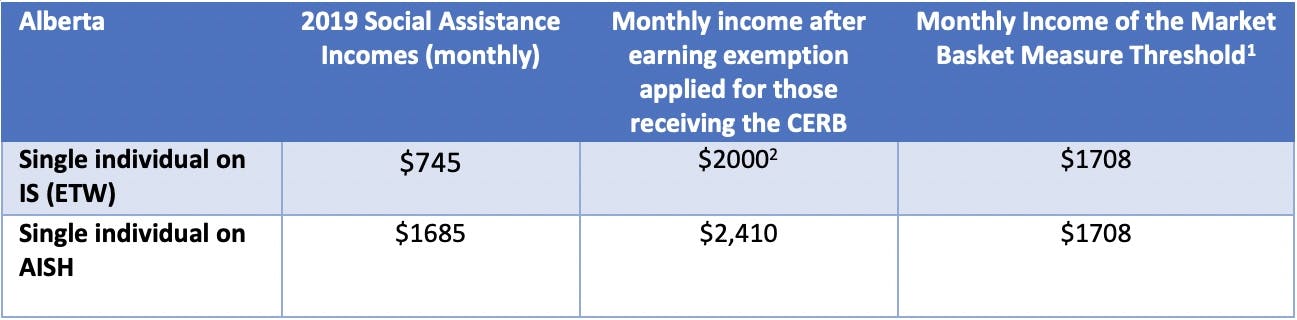

The Ministry of Community and Social Services announced that “a portion of the CERB payment will not affect provincial benefits.” A single individual on AISH who has lost income and qualifies for the CERB will receive the full $2,000 of the CERB; however, they will only be able to maintain the first $300 of their AISH payment and 25% of the remaining amount. This leaves them with a total monthly income of $2,410. A single individual on IS who is expected to work (ETW) will also be able to receive the full $2,000 of the CERB, however their entire IS payment will be clawed back after earning exemptions are applied. This is because the amount of non-exempt income is more than the full IS payment, leaving them with a total monthly income of $2,000.

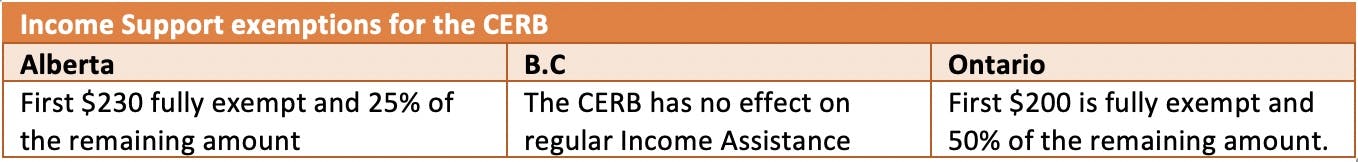

The table below compares Alberta’s earning exemption rates (for a single adult receiving IS) and treatment of the CERB with the Government of B.C. and the Government of Ontario.

Provincial Income Support is intended to enable people to meet their basic needs. Its purpose is for when someone is faced with a personal crisis or economic disruption that prevents them from working, and when they are either ineligible for or have exhausted their Employment Insurance benefit. In 2018, the Government of Canada established the Market Basket Measure (MBM) as Canada’s official poverty line to indicate the amount of money needed to pay for a basket of goods and services that individuals and families require to meet their basic needs. The table below compares the incomes of those on IS and AISH who qualify for the $2,000 per month CERB with the monthly income of the MBM for Calgary.

As a taxable benefit, the $2,000 monthly amount of the CERB for a single individual is almost on par with all regional poverty rates in Canada, including Calgary as identified in the table above. Poverty rates are important to keep in mind when we are talking about adequacy and meeting one’s basic needs. Many are wondering if the CERB payment is too high and a disincentive to work. Our perspective is that it is a sufficient amount to enable people to stay healthy, physically and mentally, providing a stable foundation from which they can return to the labour market when the economy improves.

Have questions? Contact Lee@vibrantcalgary.com.

_____________________________________________________________________________________________________________

1 THE MBM THRESHOLD FOR A SINGLE PERSON IN CALGARY IS $20,496 BASED ON HALF THE 2017 MARKET BASKET MEASURE THRESHOLD FOR THE REFERENCE FAMILY IN CALGARY, AB OF $40,207. STATISTICS CANADA. TABLE 11-10-0066-01.

2 $1327.50 OF THE $2000 CERB PAYMENT IS CONSIDERED NON-EXEMPT INCOME AND WILL BE CLAWED BACK. BECAUSE THE REGULAR IS BENEFIT AMOUNT IS ONLY $745 THE ENTIRE AMOUNT IS CLAWED BACK, LEAVING THE PERSON TO KEEP THE FULL $2000 FEDERAL CERB AMOUNT.